Feedback and Questions

Frequently Asked Questions

Please refer below some of the frequently asked questions:

What is a Budget Model?

A budget facilitates the planning and executing of an organization’s mission through the deployment of financial resources. A budget model is a quantitative system that underpins the deployment of resources through a set of principles, rules, formulas, and policies. Because resources are finite, determining how and where to invest them requires tradeoffs. For this reason, budget models are often described as a reflection of an organization’s priorities.

What is UIC’s budget model? Why are we making the change?

UIC has operated under a modified Responsibility Centered Management (RCM) budget model since fiscal year 2008. Budget models require regular review to ensure that they are sufficiently supporting a university in achieving its mission and strategic priorities. After a two-year hiatus from RCM in fiscal years 2021 and 2022, UIC resumed RCM for fiscal year 2023 while taking steps to redesign the budget model to better serve the university today.

While the existing RCM budget model has perceived strengths of incentivizing growth and innovation, it may be lacking in strategic alignment with ongoing concerns about the university’s financial sustainability. UIC is undertaking budget model redesign to address how we optimize resource allocation in light of revenue constraints, increasing costs, and varying demand on resourcing strategic priorities.

3. What is the goal of redesigning UIC’s budget model?

The goal of UIC’s budget model redesign initiative is to develop a more collaborative, transparent and inclusive budget model. UIC’s current Responsibility Center Management (RCM) budget model was developed in a different era. This project will help UIC proactively respond to current challenges towards the goal of financial sustainability and strategic alignment across our operations.

UIC aspires to develop a budget model that achieves the following:

Model Optimization

- Link the budget to strategic priorities and performance

- Advance UIC’s mission, while maintaining institutional excellence and a focus on student success

- Align incentives with strategic priorities while enhancing research, innovation, and clinical activities

- Provide appropriate incentives for collaborations within and across colleges and disciplines

Financial Sustainability

- Reflect a shared commitment to UIC’s financial health

- Inform stakeholders about financial realities, budgetary limitations and trade-offs as costs continue to outpace revenue generation

- Plan for financial impacts from the FY2026 enrollment cliff

- Enhance transparency of decision-making and funding usage along with unit level financial accountability

- Align decentralized decision-making with overall institutional goals

- Emphasize administrative streamlining and evaluate shared services to minimize duplicative administrative efforts

What progress has been made to date and what is the timeline for redesign?

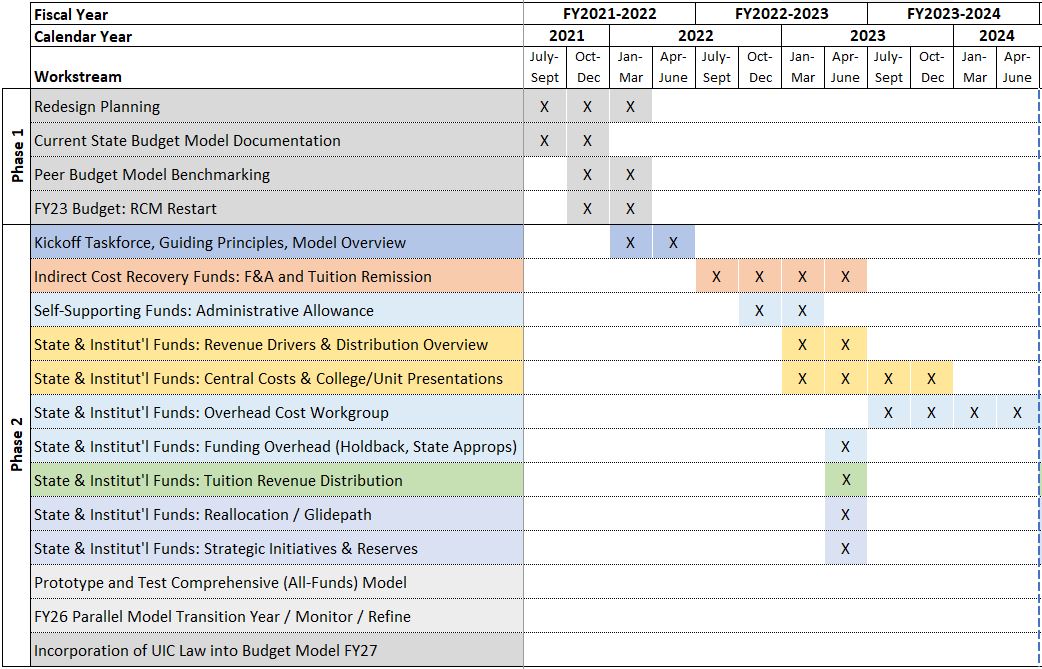

In Fiscal Year 2021-2022, UIC set out on a multi-year plan for budget redesign to assess key aspects and features of the budget model. A comprehensive model prototype is being developed as each component is evaluated so that the impacts of all recommendations can be studied in aggregate prior to implementation. The Phase 1 Task Force began its work with documentation of the current state budget model and benchmarking of peer models. Phase 2 kicked off in the Spring of 2022 with the establishment of guiding principles for redesign. An evaluation of Indirect Cost Recovery funds followed, resulting in a series of recommended changes for Tuition Remission and F&A distribution. The Task Force then reviewed State, Institutional, and Self-Supporting funds utilization through a series of College and Administrative Unit presentations. An Overhead Cost Workgroup kicked off in Fall 2023 to assess how the university funds centrally funded administrative overhead.

In January 2024, the Budget Model Redesign Task Force was temporarily paused to allow for the transition to a new Vice Chancellor for Finance, given this role’s importance in shaping financial sustainability for UIC and in serving as an Executive Sponsor for Redesign alongside the Chancellor, Provost, and VCHA. Once the new VCF is onboard going into Fiscal Year 2024-2025, leadership will review the Task Force’s body of work in the context of Chancellor Miranda’s articulated strategic priorities before advancing the initiative. In the meantime, the work of the Overhead Cost Workgroup continues under the leadership of Associate Vice Chancellor, Michael Moss and the Office of Budget and Financial Analysis.

How is the redesign process being accomplished?

The redesign work and underlying analyses are being accomplished through an interdisciplinary taskforce appointed by former Chancellor Amiridis and current interim Chancellor Javier Reyes.

The Budget Model Redesign Taskforce is comprised of faculty, deans, fiscal officers and administrators under the leadership of co-chairs acting Provost and Vice Chancellor for Academic Affairs Karen Colley, and Associate Vice Chancellor for Budget and Financial Analysis Michael Moss. Mary Ellen Borchers serves and the Budget Model Redesign Project Director, facilitating the work of the Task Force and Workgroups and engaging stakeholder groups along the way.

The Taskforce will review the following budget model aspects and recommend changes to meet a set of overarching guiding principles:

- Tuition revenue allocation and distribution

- Bad debt, waiver and institutionally funded financial aid

- Indirect cost recovery (ICR) revenue allocation and distribution

- Administrative allowance revenue allocation and distribution

- Moving the UIC School of Law into the model

- Administrative costs and shared services opportunities

- Related issues that arise throughout the evaluation and analysis work

Who is involved in the decisions to change the budget model?

The Budget Model Redesign Taskforce is charged with collaborating broadly across the university to develop recommendations, communication and implementation plans that address the goals and aspirations of the budget redesign outlined above.

The Taskforce’s proposed changes to the model will be reviewed with shared governance stakeholders, including Dean’s Council, the Executive Senate and Senate Committee on Budget, Planning & Priorities, Business Officers Council, APAC and SAC. Input and open dialogue will be ongoing throughout redesign. The Taskforce’s final recommendations shall be reviewed and approved by the project’s Executive Sponsors: the Chancellor, Provost, Vice Chancellor for Finance, and Vice Chancellor for Health Affairs.

What is Responsibility Centered Management (RCM)?

Responsibility Centered Management (RCM) is a decentralized approach to budget allocation that assigns greater control over resource decisions to deans and unit heads. Under this budget approach, revenue-generating areas are referred to as “responsibility centers” with all or most of the institution’s revenues and support costs assigned to them. RCM’s underlying premise is that the decentralized nature of the model entrusts academic leaders with more control of financial resources, leading to more informed decision-making and better results or outcomes for the University as a whole.

In centralized budgeting models, academic program decision-making is largely decoupled from financial responsibility. By allowing responsibility centers to control the revenues they generate, decision makers are better able to understand both the academic and financial impacts of their decisions. Academic planning and resource decisions are more transparent within the unit and throughout the institution. Armed with improved information and the potential to retain increased financial resources, decision makers at the college/campus level may leverage limited resources more effectively, improving university accomplishments and outcomes.

Three basic principles underlying this financial management system can be simply stated: (1) all costs and income attributable to each academic unit should be assigned to that unit; (2) appropriate incentives should exist for each academic unit to increase income and reduce costs to further a clear set of academic priorities; and (3) all costs of other units should be allocated to the academic units.[1]

A classic RCM model provides all revenues to the revenue generating units and assesses central administrative overhead and facility costs based on a prescribed allocation/usage basis. Hybrid models of RCM exist due primarily to the difficulty in assessing administrative overhead and facilities usage. For example, a single college may not be the sole occupant of a building, or utilities may not be separately metered. Other reasons for hybrid models include culture, preservation of central budget flexibility, and ability to respond to state appropriated funding changes.

[1] Whalen, Edward L. Responsibility Center Budgeting: An Approach to Decentralized Management for Institutions of Higher Education Indiana University Press, 1991. (Foreword. T. Ehrlich.)

What is the history of Responsibility Centered Management (RCM) at UIC?

The UIC Resource Task Force formed by Provost Michael Tanner in 2007, was given the charge to:

- Examine the current resource picture.

- Make suggestions for innovations.

- Generate a comprehensive set of data to enable a clear picture of revenues and expenses for all major units.

- Provide metrics and benchmarks to judge performance.

The Resource Task Force Report recommended decentralization of resources as a means to increase revenues through a more entrepreneurial approach. UIC adopted a modified Responsibility Center Management (RCM) budget model in FY 2008.

The RCM model has stayed largely intact with minor updates until FY 2021 when it was suspended due to the COVID-19 pandemic. The purpose of the suspension was to protect colleges from the uncertainty around potentially significant enrollment declines. These significant declines did not fully materialize, although some individual colleges experienced small declines or other revenue impacts. The model remained suspended in FY22 due to continuing uncertainty around the direction of the pandemic.

What has changed in our budget environment since RCM was implemented at UIC?

A number of financial challenges across higher education have arisen over the last fifteen years that have constrained revenue growth and driven up expenses. UIC has not been immune to such challenges, with record enrollments but flat undergraduate tuition rates and escalating salary costs. With more students to serve and higher costs to do so, now combined with inflation and post-pandemic challenges, expenses are outpacing revenues. Specific changes that have impacted UIC’s budget include:

- Declining State Support – Appropriations from the State of Illinois (also known as EAF, or the Educational Assistance Fund) has been declining slowly since 2010, reflective of a nation-wide trend. Between FY 2017 and FY 2023, State Appropriations have decreased by 17%. State support is the second largest source of unrestricted funds for the university, the largest being tuition.

- Frozen Tuition Rates – Base undergraduate resident tuition rates were held flat between FY 2016 and FY 2020 by the University of Illinois Board of Trustees in response to public and legislative pressures. This was in part a response to consecutive years of significant tuition rate increases prior to 2016. A modest 1.81% increase, pegged to the rate of inflation, was authorized for FY 2021 and again in FY23. However, these rate changes only apply to each entering class or transfer students and it takes four years for the full impact of the rate change to be realized. Referred to as guaranteed tuition (the Illinois Truth in Tuition Act 110 ILCS 675/20-125) mandates the tuition rate for new undergraduate students enrolled in a degree-seeking program be locked for a four-year period.

Frozen Rates

| Tuition (per semester) | AY16-17 | AY17-18 | AY18-19 | AY19-20 | AY20-21 | AY21-22 | AY22-23 | 6 Yr Avg Chg |

|---|---|---|---|---|---|---|---|---|

| Undergrad Resident Guaranteed Rate | $5,292 | $5,292 | $5,292 | $5,292 | $5,388 | $5,388 | $5,485 | |

| Tuition Increase | $0 | $0 | $0 | $96 | $0 | $97 | ||

| % Tuition Increase | 0.00% | 0.00% | 0.00% | 1.81% | 0.00% | 1.8% | 0.60% |

continue

- Salary Increases with insufficient new funding to offset escalating costs – The combination of declining state support and frozen tuition rates continues to create significant challenges in addressing rising costs. Salaries make up 83% of state funded university expenditures.

- Impact of Budget Impasse – The state did not pass a budget in FY 2016 and it was delayed for FY 2017 until after that fiscal year closed. Approximately 72% of the appropriation revenue amounts from FY2015, were never fully restored to the university in FY2016.

- Interdisciplinary programs – Over time, both education and research have become more interdisciplinary. The current RCM budget model does not easily address revenue sharing amongst multiple colleges for the same program. In these circumstances, manual effort is required following agreements outside of the model, e.g. biomedical engineering.

What other types of budget models are used in higher education today?

Incremental Budgeting[1]

Definition

This is a traditional budget model in which budget proposals and allocations are based upon the funding levels of the previous year and or projected revenues expected in the future year. Only new revenue is allocated and when decrements are required, typically these are made in an across-the-board fashion.

Benefit

Incremental budgeting has historically been attractive to institutions of higher education because it is easy to implement, provides budgetary stability, and allows units and institutions to plan multiple years into the future, due to the predictability of the model.

Drawback

This model is limited in its vision, as it is difficult to determine where costs have been incurred and how these costs contribute to revenue and value creation. Institutions are accountable for what they spend in the most basic sense. When reductions are required, as has been the case with most states’ appropriations, the across the board approach does not typically take into effect the variations in enrollment by program.

Zero-Based Budget[1]

Definition

At the beginning of every budget planning period, the previous year’s budget for each unit is cleared. Every university college and administrative unit must re-request funding levels, and all spending must be re-justified.

Benefit

Zero-based budgeting is an effective way of controlling for unnecessary costs. Since departments and divisions do not automatically receive a certain sum each year, all money allocated to a unit has a purpose, keeping waste and discretionary spending to a minimum. Zero-based budgeting reduces the “entitlement mentality” with respect to cost increases, and has the potential to make budget discussions more meaningful. This approach is not practical for a large research university but may work well at a small liberal arts colleges.

Drawback

Zero-based budgets take longer to prepare, are not practical for large, decentralized universities and may “be too radical a solution for the task at hand.”

Activity-Based Budgeting[1]

Definition

Activity-based budgeting awards financial resources to institutional activities that see the greatest return (in the form of increased revenues) for the institution. Adoption may involve:

- Developing activity groupings for budgeting, in coordination with campus leaders and constituents;

- Developing fund source groupings;

- Designing budget processes whereby campus leaders use activity taxonomy and allocation plans to align resources to institutional strategic objectives; and

- Implementing an activity-based campus budget allocation process

Benefit

If the University can accurately state where revenues are coming from and link these revenues to broader strategic objectives, this method may increase revenue moving forward.

Drawback

Implementation of an activity-based model requires a substantial time and resource commitment, which may not be feasible for some institutions.

Centralized Budgeting[1]

Definition

Centralized budgeting requires most if not all, decision-making powers to be in the hands of upper-level administration. Typically, colleges and universities combine aspects of centralized budgeting with decentralized budgeting.

Benefit

A more centralized budgeting system may be a prudent way to navigate difficult financial circumstances, due to the powers invested in top administrators to make tough decisions for the university as a whole. In a system combining central budgeting with another process, the rationale for choosing which units are centrally budgeted may be adaptable. For example, when combined with performance-based funding, colleges might centrally budget those divisions for which no performance metrics can be reliably identified. Another reason to implement centralized budgeting is that some expenses are necessary to the basic functioning of divisions and are therefore not optional. A common example of centralized budgeting under this rationale is IT equipment—e.g., computers, printers, and software. If all faculty require a computer to perform their duties, this is a cost which cannot be compromised, and can be centrally budgeted to ensure that the college keeps the cost under control.

Drawback

When budgeting is centralized and the element of competition is removed, departments may be less motivated to generate revenue.

Performance-Based Budgeting[1]

Definition

Whereas an activity-based model allocates budget based on the amount of revenue-generating activity a unit undertakes, a performance-based model awards budget based on performance, as determined by a number of defined outcomes. The most effective performance budgets will show how dollars fund day-to-day tasks and activities; how these activities are expected to generate certain outputs; and what outcomes should then be the result.

Benefit

A performance-based budget should give an institution a good idea of how money is expected to translate into results. Performance-based systems are often imposed on public systems of education as a result of greater accountability demands. Linking the funding of public institutions to the results they deliver lends an increased level of transparency to expenditures among institutions reliant upon public financial support. Performance-based funding is not new to higher education, it is now more likely to be legislatively mandated than at any other time in history.

Drawback

The budget process must include time for the review of performance measures (which itself necessitates a prior collection and analysis process) and time for discussion of performance against expectations. Only then can dollar values be assigned to divisional outcomes.

[1] https://www.hanoverresearch.com/insights-blog/6-alternative-budget-models-for-colleges-and-universities/

11. Are other universities making these kinds of changes?

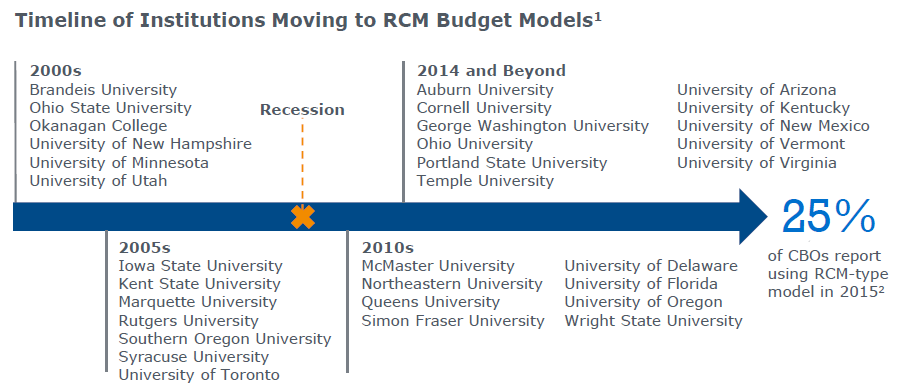

It is common practice for institutions to evaluate their budget model every 5-10 years to address new challenges and shifts in priorities. Many universities trended toward RCM models in the 2000’s in response to increasing financial pressures on higher education to create transparency, control costs, and incent revenue growth. [1]

[1] EAB. Aligning the Budget Model to Strategic Goals Executive-Level Decision Points to Ensure Impact on Cost, Growth, and Strategy. Business Affairs Forum, 2016.

Continue

Today, many institutions are adopting hybrid models that include elements of classic centralized and decentralized models. The primary advantage of centralized models is to preserve resources centrally to invest in strategic priorities and drive the institutional vision. Conversely, decentralized models drive unit-level financial accountability and shift resources to areas of high-growth. Given the merits of each approach, many institutions operate under hybrid models that capture the benefits of both while minimizing their respective limitations.

Unfortunately, there is not a single one-size-fits-all hybrid model that every institution should follow. Institutions have employed a variety of hybrid models, ranging from 100% activity-based tuition revenue allocation with centrally held state appropriations to primarily incremental models with an activity-based formula for new tuition revenue. Given this variation, the challenge is to design a model that fits UIC.